Calculate medicare tax 2023

Suppose a single tax filers 2020 MAGI was just 1 over the threshold 91001. 26 2013 the IRS issued final regulations TD 9645 PDF implementing the Additional Medicare Tax as added by the Affordable Care Act ACA.

Moaa Here S Why Your Medicare Part B Costs May Drop In 2023

The maximum Social Security.

. The FICA portion funds Social Security which provides. This calculator includes the additional 09 Medicare tax on Social Security wages and self-employment income in excess of a threshold based on your tax-filing status. For both of them the current Social Security and Medicare tax rates are 62 and 145 respectively.

0 for covered home health care services. The standard Part B premium for 2022 is 17010. You pay all costs.

Pundits are suggesting premiums will decrease for 2023. The exact amount of your tax payable or refund can only be calculated upon lodgment of your income tax return. The standard Part B monthly premium in 2021 was 14850 and in 2022 the amount increased to 17010.

FICA taxes include both the Social Security Administration tax rate of 62 and the Medicare tax rate. Calculate Your 2023 Tax Refund. Income tax Medicare and allowances tax tables for 2023 as used on the Australia Tax Calculator on iCalculator.

In addition to this you will pay 1756 as a state income tax in Louisiana. The 2023 tax calculator is designed to provide quick income tax. ICalculator IN Excellent Free Online Calculators for Personal and Business use.

6 hours agoDespite covering preventative care Medicare does not cover the shingles vaccine and at times charges up to 200 for the shot. If youre single and filed an individual tax return or married and filed a joint tax return the following. The total amount of federal taxes you will pay will be 4868.

So each party pays 765. Thus the total FICA tax rate is 765. Estimate my Medicare eligibility premium.

Prepare and e-File your. For 2024 IRMAA your forecast is 101000 with zero. The salary calculator for 202223 India Tax Calculations.

Please note that the self-employment tax is 124 for the Federal Insurance Contributions Act FICA portion and 29 for Medicare. The total amount of social security and Medicare. Monthly Medicare Premiums for 2022.

Begin tax planning using the 2023 Return Calculator below. Today the Centers for Medicare Medicaid Services CMS released the Announcement of Calendar Year CY 2023 Medicare Advantage MA Capitation Rates and. 19450 copayment each day.

In January that will change. The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total. As of 2022 the Medicare tax is 145 of your wage and the social security tax is 62 of your salary.

Medicare Part B premium. Calculates tax and salary deductions with. Employers and employees split the tax.

While zero-premium liability is typical for Part A the standard for Medicare Part B is a premium that changes annually determined by modified adjusted gross. This Tax Return and Refund Estimator is currently based on 2022 tax tables. On the other hand if you make more than 200000 annually you will pay.

Estimate in 2022 and e-File in 2023. 2021 Tax Calculator Exit. Social Security and Medicare Withholding Rates.

The Additional Medicare Tax. Calculate Your 2023 Tax Refund. Based on the Information you entered on this 2021 Tax Calculator you.

This Tax Calculator Lets You Estimate Your Taxes. It will be updated with 2023 tax year data as soon the data is available from the IRS. Calculate your total tax due using the MN tax calculator.

The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total. Based on your forecast It is pretty sure that the 2023 IRMAA will be around 97000 or 98000 for individual or MFS. In that case Medicare adds the full additional 68 a month to the 17010 base Medicare Part.

Days 101 and beyond.

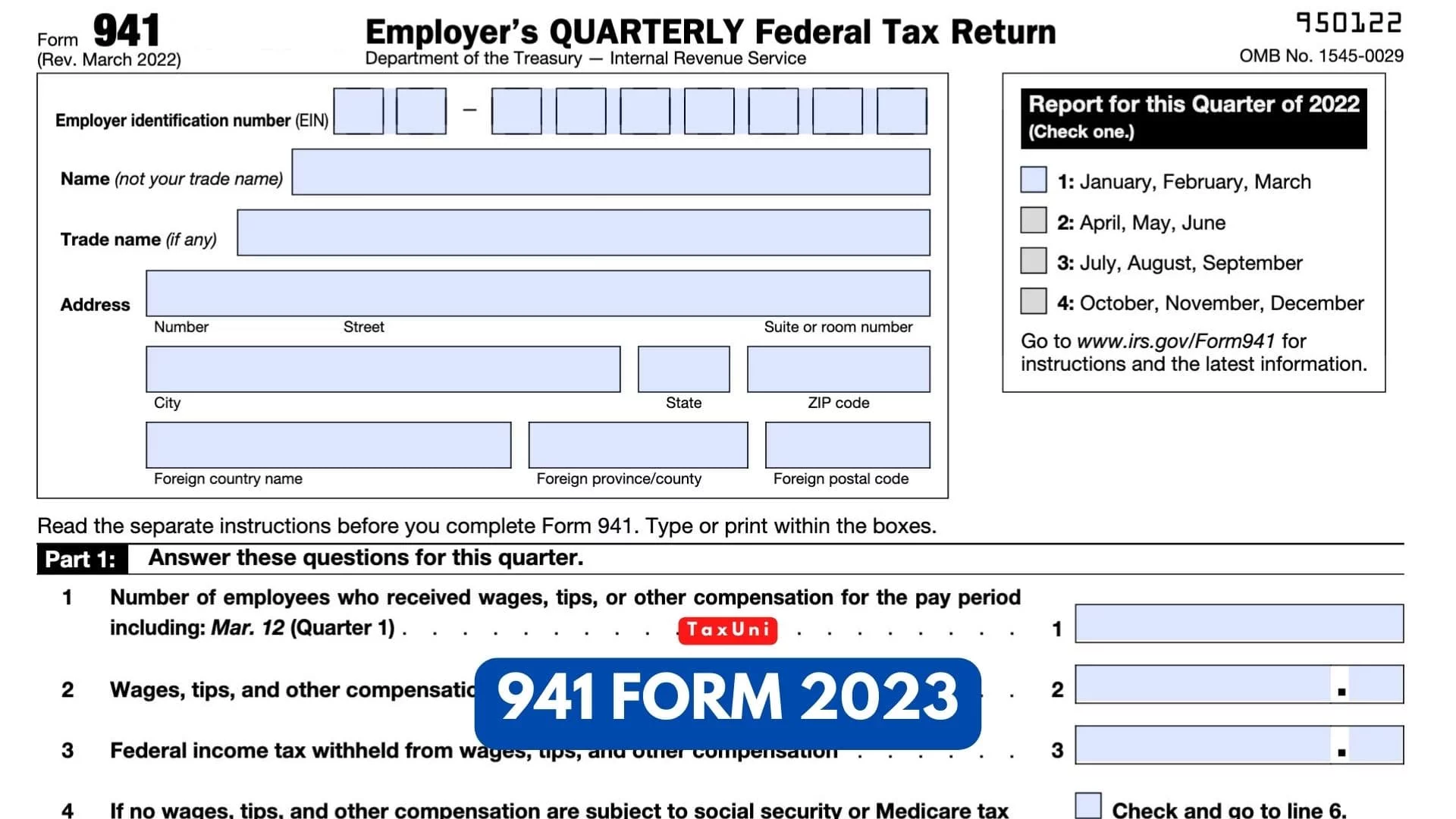

941 Form 2023

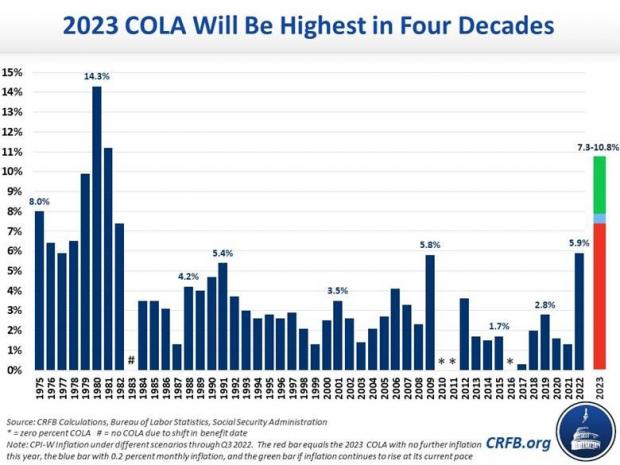

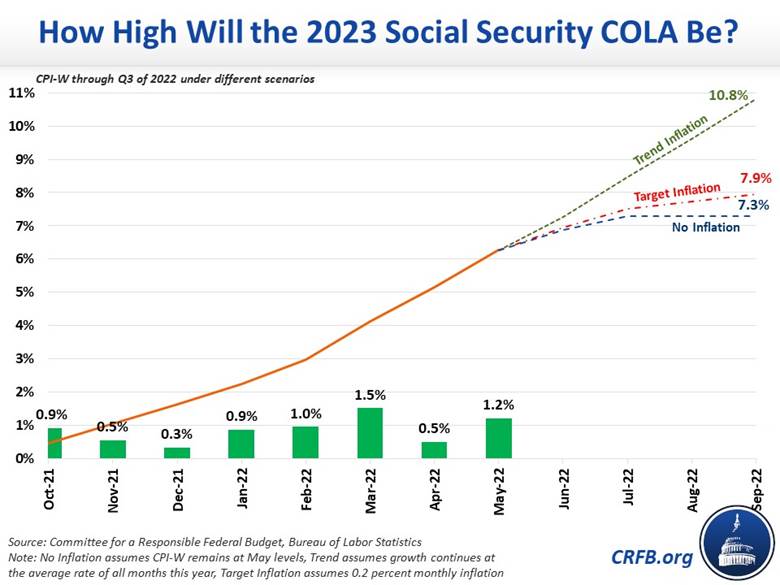

Social Security Could Get A 7 6 Raise In 2023 But It S Not All Good News The Motley Fool

My First Million By 16th October 2023 How To Get Money Credit Card App Business Travel Outfits

Proposed Law Impact On Social Security Taxable Wage Base Isdaner Company

2022 Wage Cap Jumps To 147 000 For Social Security Payroll Taxes

Form 941 For 2023

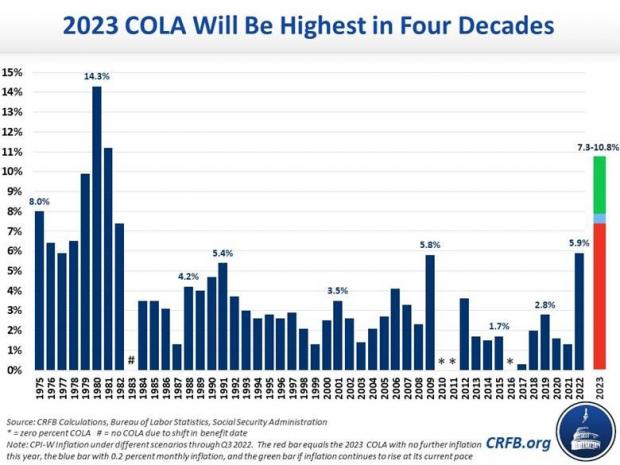

Here S How Much Social Security Cola Could Increase In 2023 Wcnc Com

Here S How Much Social Security Cola Could Increase In 2023 Wkyc Com

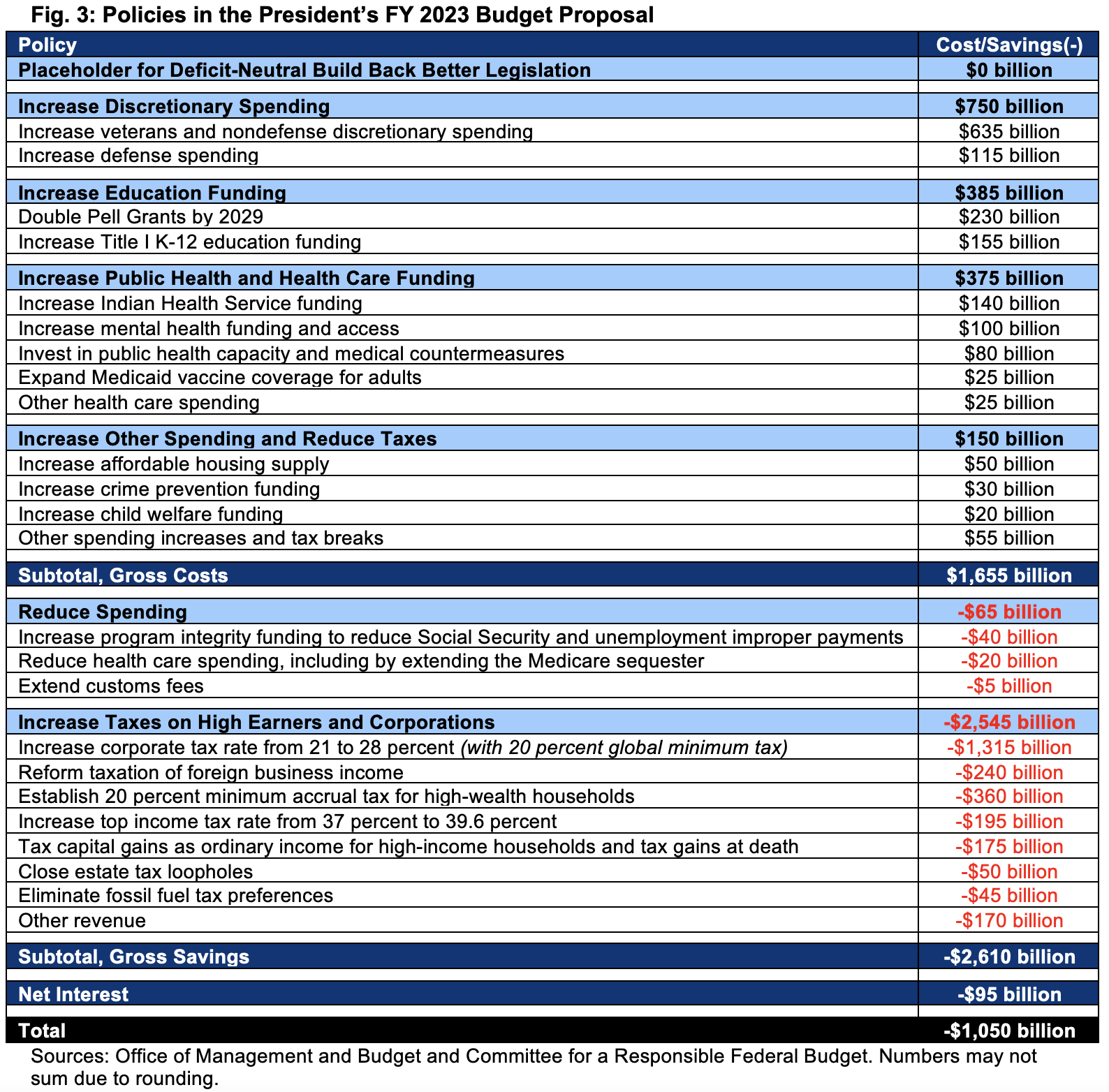

Analysis Of The President S Fy 2023 Budget Committee For A Responsible Federal Budget

Increase In Social Security Benefits In 2023 How Much Will Recipients Get Silive Com

Social Security What Is The Wage Base For 2023 Gobankingrates

Social Security Benefits Set For A Huge Boost In 2023 Analysis The Fiscal Times

The 2023 Social Security Cola Will Be Higher Than You Think Hint It S All About Medicare Premiums Youtube

4 Social Security Changes To Expect In 2023 The Motley Fool

You Won T Believe The Size Of This 2023 Social Security Cola Estimate 401 K Specialist

Could 2023 Social Security Cola Hit 9 Benefitspro

Early Social Security Ssi Cola Predictions For 2023 Youtube